dependent care fsa coverage

The IRS sets dependent care FSA contribution limits for each year. Getty Images Child care is expensive and many families.

Health Welfare Benefits National Benefit Services

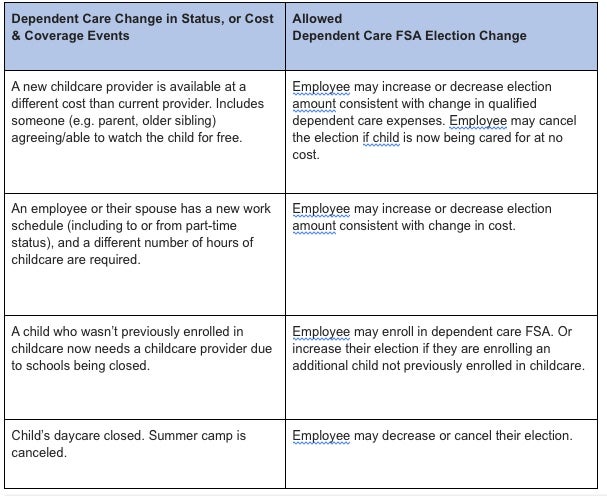

Dependent Care FSA Cost or Coverage Changes.

. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. In one great option is a Dependent Care Flexible Spending Account DCFSA. Cost in dependent care coverage.

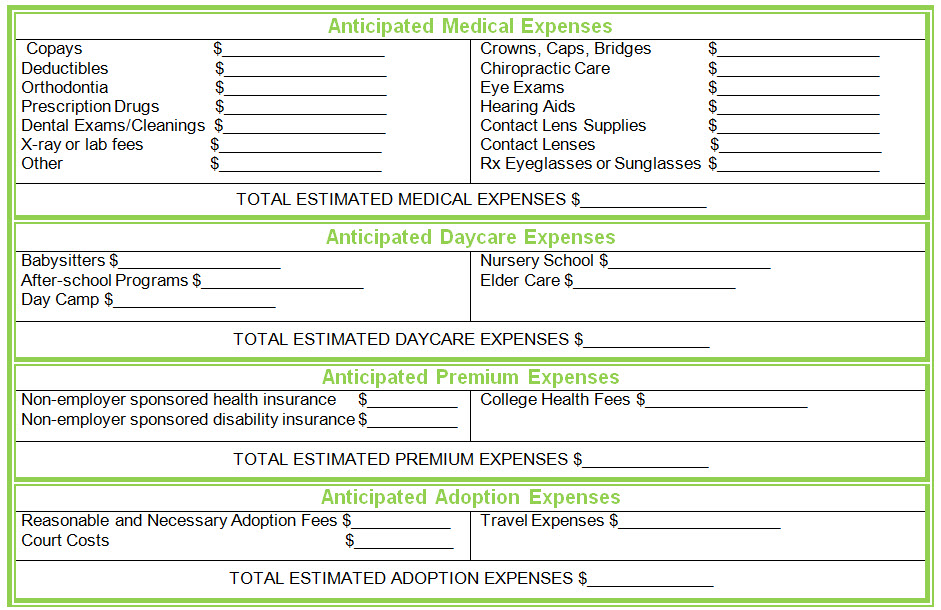

Flexible Spending Dependent Care Accounts are a great way to aid your employees in paying for out-of-pocket medical expenses. For 2022 the IRS. A Dependent Care FSA account is generally used to cover expenses for the care of a qualified dependent under the age of 13 while the you and your spouse are working or looking for work.

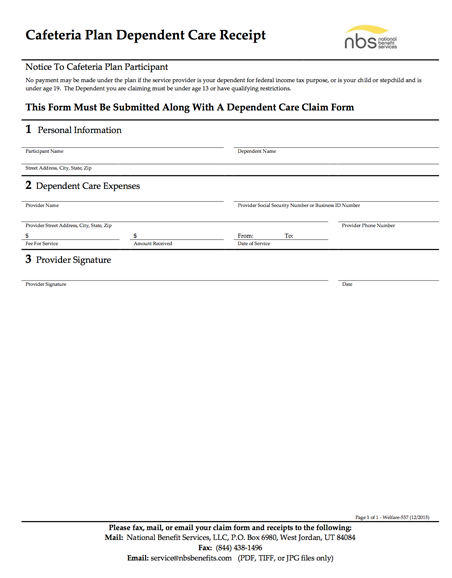

IRS Publication 503 Child and Dependent Care Expenses contains detailed information for determining whether a taxpayer may claim the Dependent Care Credit. Getting Reimbursed with a Flexible Spending Account. Reimbursements from FSAs must be accompanied by the appropriate.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. Watch this short video to learn how to get the most from your Flexible Spending Account. This can make supporting a family or caring for a.

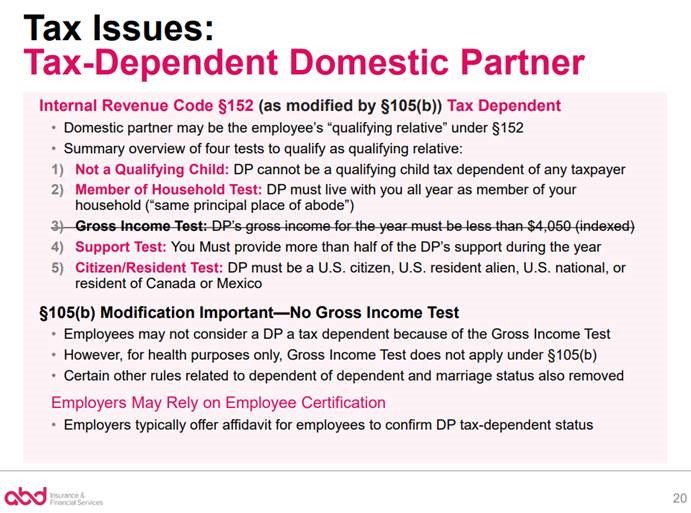

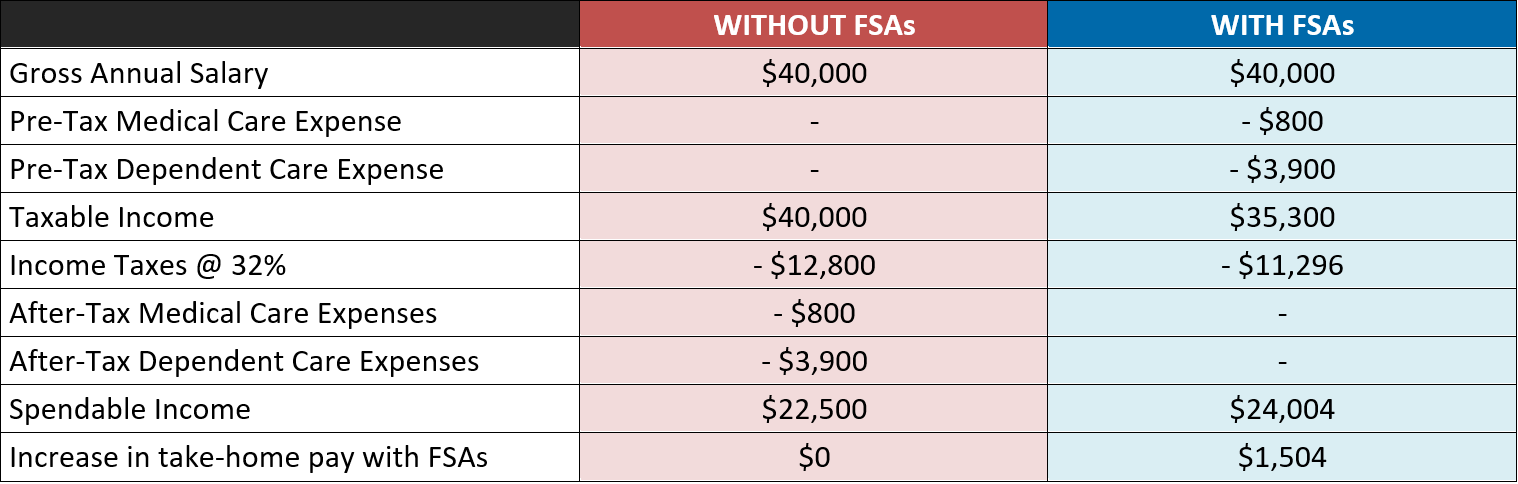

The Dependent Care Flexible Spending Account allows you to set aside pre-tax money from each paycheck which you can use to pay for dependent care services. A dependent care flexible spending account FSA allows your employees to save for qualified dependent care expenses. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend.

The TexFlex health care FSA is administered. The employee will generally have eligible dependent care FSA expenses for the services provided prior to the day the child reaches age 13. Learn about Dependent Care FSAs Health Care FSAs and Limited Purpose FSAs.

With a Dependent Care FSA you can use your pre-tax funds to pay for childcare for dependents age 12 or. Flexible Spending Accounts FSAs require substantiation. Dependent Care FSA Limits for 2022.

A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves. A dependent care FSA lets a household set aside up to 5000 to pay child care expenses for kids under age 13. This account helps you pay for costs such as dependent care before and after school care nursery school preschool and summer day camp.

Judgment Decree or Order including QMCSOs Approved Leave. Dependent Care FSA Contribution Limits for 2022. Entitlement to Governmental Benefits.

The Internal Revenue Service IRS limits the total amount of money that you can contribute to a dependent care FSA.

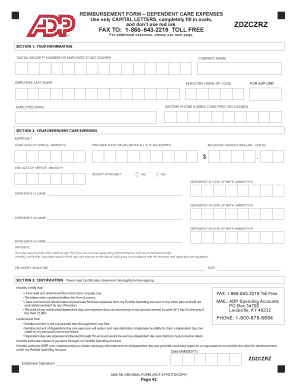

Dependent Care Fsa Claim Form Adp Flexible Spending Accounts Fill And Sign Printable Template Online

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Flexible Spending Accounts Fsa Pro Flex Administrators Llc

Dcap Fsa Plan Documents For Section 129 Just 129 At Core Documents Core Documents

Qualified Dependent Care Expenses Healthequity

Fsa Eligible Expenses What Purchases Count

Dependent Care Assistance Account P A Group

New 2022 Brochure For Dependent Care Assistance Plan Fsa Benefit Plan Document Core Documents

Flexible Spending Accounts Hrc Total Solutions

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Health Fsa And Dependent Care Fsa For Parents

Employer Provided Dependent Care Fsa Benefit Plans Optum Financial

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Flexible Spending Accounts Amwins Connect Administrators

Flex Spending Accounts Hshs Benefits

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services